In modern times, a large part of the stability of the economy depends on the BFSI sector, generally considered to be the backbone of any economy. The early adoption of digitization of the sector was the biggest positive during the lockdown. Wizikey looks at the top 100 players in this category and the factors that prompted the media to write about them. This report is an analysis of the sub-sectors of the BFSI industry. It delves into what worked and what did not, and ultimately takes a closer look at the top 10 players and their narratives in the media.

Indian banking models like small finance banks and payment banks have found acceptance and leaders in the respective categories, improving the arterial support system during the COVID-19 crisis. While traditional banking institutes were in the news more often than not for their services, practices, offers and overall announcements for the public, the insurance sector was being mentioned because of increase in risk in nearly every aspect of our lives. The year 2020 also saw the emergence of the support sectors of NBFCs and small finance banks. And the wave of “no-touch” services made sure that the sectors of digital payment banks and neo banks got their fair share of prominence in the media.

The sectors also saw some big names having some negative public sentiment because of news on malpractices, and ultimately faced heavy losses. The resultant increase in NPAs of the banking sector may see it go in the red once this financial year closes.

The Year of Convergence – The Traditional Meets Neo

Demand Backed Digitization

Traditional banks were trying to match the massive shift in demand from physical banking to online banking. Banks and most of the BFSI players have reimagined and built simple, intuitive, digital-native and ecosystem-driven customer journeys for better customer engagement.

Contactless payments, through QR Code, wallets, UPI or contactless cards, gained popularity as they offered convenience, safety and security while allowing the consumers to maintain physical distancing. While uninterrupted 24 X 7 digital banking services were launched, the real differentiator for banks was their ability to play a more integral role in their customers’ lives.

Reimagining For COVID-19

A full-blown pandemic led to a significant reduction in demand from SMEs/ corporate, structural shifts in customer behaviour, and transformation of employee roles and overall operating models. While the government and RBI swung into action with targeted interventions, prolonged disruption resulted in further initiatives facilitating structural changes in the industry.

Emergence of a Supporting Ecosystem

NBFCs and Small Finance banks created a parallel cash flow to support the economic ecosystem during the crisis. With the rise of innovations in fintech solutions, banks and NBFCs enabled small and medium-sized enterprises to enhance their financial caliber and achieve business expansion.

Leaders in Each Sector

Sector Wonders

Banking

The three banks that transformed themselves almost overnight to serve the Indian consumer through the arterial reach include ICICI, HDFC, and SBI. All three had high sentiment and volumetric scores. These leaders of the banking ecosystem trumped their newer counterparts including Axis and Kotak Mahindra in both quantity and quality of news.

The graph below shows the Leaders in the right quadrant as far as creation of news is concerned. The surprise entrant in the Leaders Quadrant – Yes Bank is an anomaly. While it trumps in volume it trails in sentiment. This bank was in the news for its poor performance and management resignation. It did finally it manage to pick up steam towards the end of the year and improve sentiment when its stocks started soaring on the BSE.

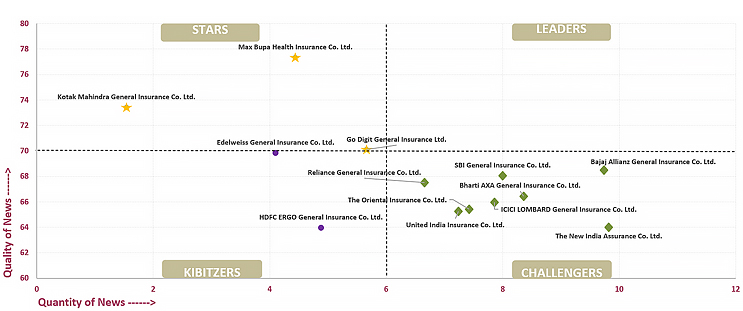

General Insurance

It’s a cautionary tailwind that health insurance caught in 2020. A category that is usually muted in BFSI, general insurance found much more excitement with crisis driven news creation. The top player, Bajaj Allianz General Insurance emerged as the challenger with high news volumes with Max Bupa as the star with high quality of news.

Again, what’s interesting to see is that no player retains a leadership slot with high quality as well as quantity of news. Very few players see a higher quality of news in this category, leaving a vacant spot in the leader quadrant.

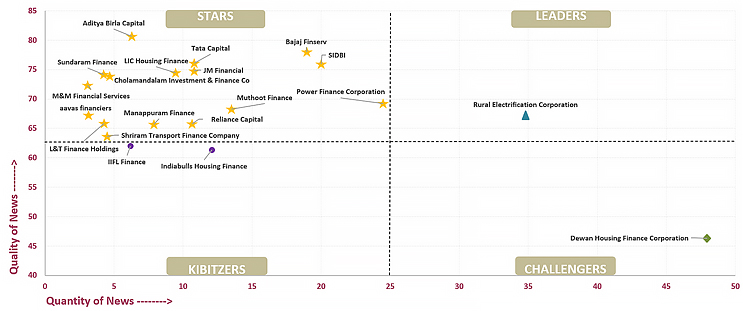

NBFC

NBFC emerged as the primary source of capital for MSMEs. In the COVID-19 world, banks have been lending more to non-banking financial companies (NBFCs), increasing their overall exposure to them. This is reflective in the overall volume and sentiment in the category across players. Rural Electrification Corporation emerged as the only player in the leader quadrant. Overall, Dewan Housing ranked 1 in the category and REC on rank 2. SIDBI took the 2nd runner up with an overall Wizikey rank of 25.

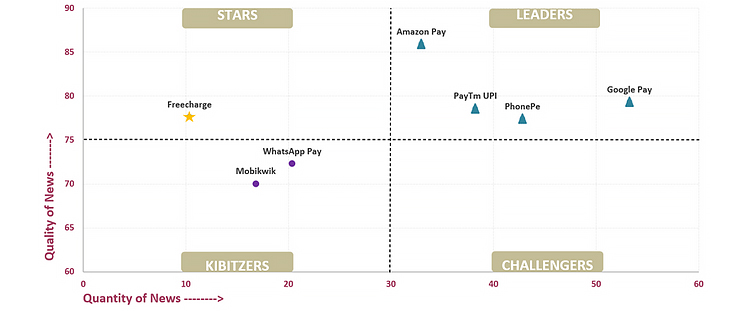

Wallets and UPI

2020 saw UPI and Wallets spring into high action as they found a new opportunity in making a dent in the market. In a locked down world, Google Pay emerged as the number one mover and shaker, followed by Phone Pe. While Whatsapp buzzed with the launch of payments it stayed behind all other players in the category.

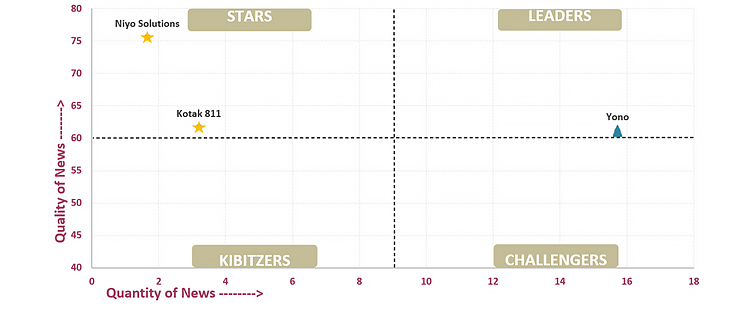

Neo Banks

These branchless counterparts of traditional banks rode the trend owing to the digitization that has been under progress for years. YONO emerged as the number one followed by Niyo and Kotak 811.

Click here to get the complete detailed report

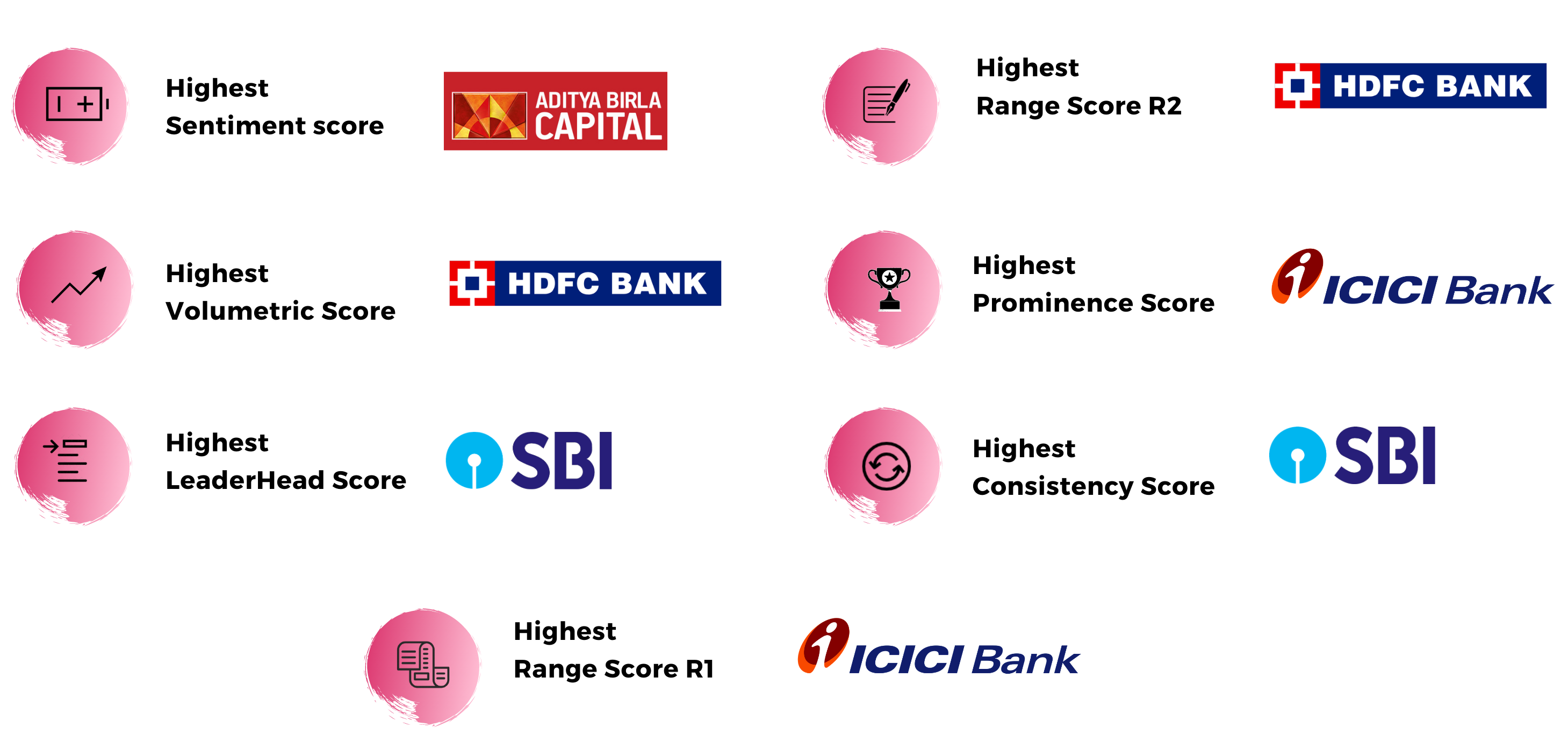

Overall Metrics wise Top players

Wizikey Top 10 players in BFSI Movers & Shakers Report

To collect your Wizikey Top 100 Newsmaker badge, write to us at [email protected]!

If you would like to download your own copy, simply click here